Commercial Loan Origination Software In commercial Lending

At Nexys, we deliver cutting-edge Commercial Loan Origination software solutions that simplify financial technology and real estate operations. Discover how Nexys LOS solutions can transform the way you work.

Streamlining Complex Lending: What to Know About Commercial Loan Origination Software

What is a Commercial Loan Origination System?

In the world of commercial lending, intelligence in finance and speed alone isn’t enough. Unlike consumer loans, commercial lending involves layered strategy in underwriting, entity-level risk assessments, and custom deal structures and data silos. To navigate this complexity, lenders need more than a basic data entry loan platform—they need Commercial Loan Origination Software purpose-built for business and investment lending decision-making for customers.

What is Loan Origination Software?

Commercial Loan Origination Software (CLOS) is a specialized digital platform designed to manage and automate the full lifecycle of business-purpose loans. This includes everything from borrower onboarding and credit analysis to multi-tier approvals, document management, data entry, and funding.

What sets it apart from general loan software is its ability to handle:

- Entity-based underwriting (LLCs, partnerships, trusts)

- Custom loan structures (interest-only, balloon payments, tiered rates)

- Multi-party collaboration (brokers, legal counsel, fund managers)

- Commercial-specific compliance workflows for cash flow analytics and pricing strategy

From real estate investors to SMBs seeking working capital, commercial loan origination systems are tailored to support high-value, high-complexity transactions with intelligent user-friendly data entry. Cost control and sustainable growth with our software ensure a winning corporate formula. Resources to help navigate the origination software help customers gain knowledge into website navigation. Utility and preference can all be customized in our safe cloud enviroment to leverage niche infrastructure for retail bankers or business loans. Security is also our top priority with automation for marketing, API vendor integrations, and marketplace news.

Why Commercial Lenders Need Purpose-Built Commercial Loan Origination Software

Traditional loan origination tools often fall short when applied to commercial lending. Manual reviews, back-and-forth emails, and disjointed approval chains can slow deals down and introduce unnecessary risk.

With purpose-built software, commercial lenders can:

- Accelerate deal flow with custom workflows for loan products like DSCR, bridge, and construction loans

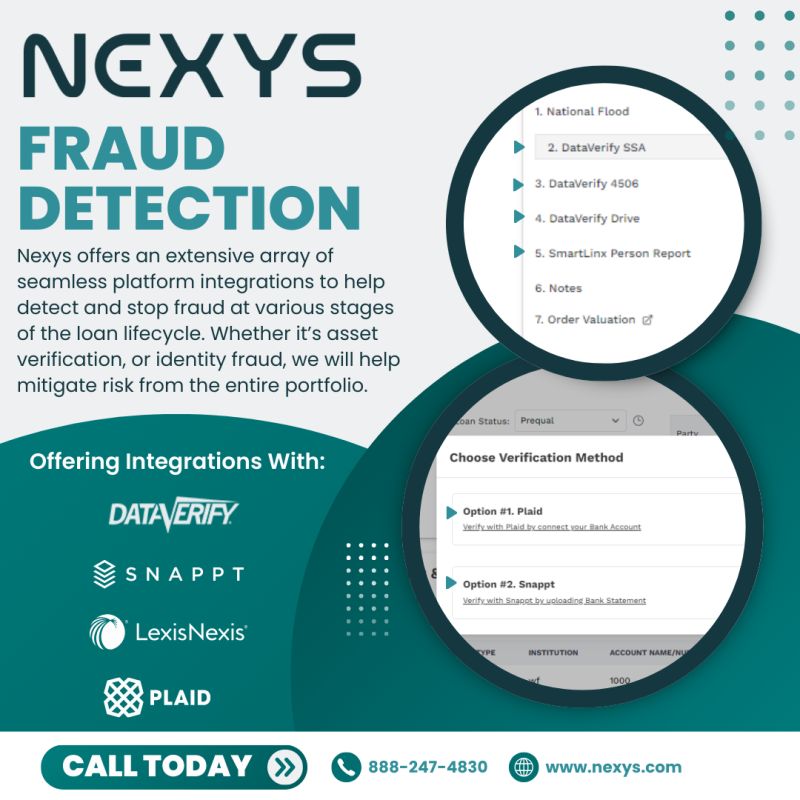

- Enhance borrower due diligence by integrating with commercial credit bureaus and business financial data

- Track performance metrics across teams, loan types, and asset classes

- Stay compliant with commercial lending regulations and investor requirements

A robust commercial origination system removes bottlenecks and lets lending teams focus on high-impact decisions instead of chasing down spreadsheets and PDFs.

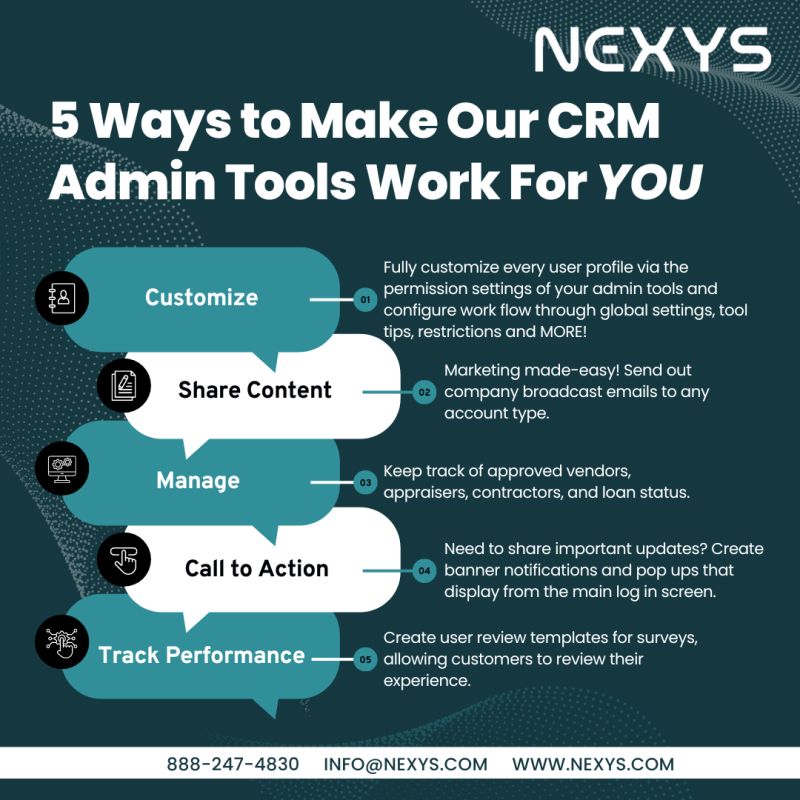

Features That Define Modern Commercial LOS Platforms Community

An advanced Commercial Loan Origination Software solution should include:

1. Customizable Commercial Loan Origination Software Workflows for Commercial Lending

Adaptable to unique loan types like commercial real estate, SBA, asset-based lending, and multifamily portfolios.

2. Integrated Financial Analysis Commercial Lending Software System

Pull business tax returns, profit/loss statements, and DSCR metrics directly into the underwriting module.

3. Commercial Lending Software Entity Management

Track complex borrower structures—LLCs, trusts, holding companies—with full transparency.

4. Third-Party Integrations for Commercial Lending Solutions

Link to credit vendors, appraisers, title providers, and internal CRMs to create a unified system of record.

5. Audit-Ready Compliance for Commercial Lending Software

Ensure your portfolio meets regulatory and investor standards with automated policy checks and full documentation logs.

Who Uses Commercial Lending Software?

Consumer Commercial Lending platforms are used by a range of consumers – professionals involved in business-purpose lending, including:

- Private and hard money lenders funding commercial real estate deals

- Regional banks and credit unions originating SBA and equipment loans

- Mortgage brokers and investor groups structuring portfolio transactions

- REITs and capital providers tracking pipeline and performance metrics

Regardless of deal size, the need for accuracy, automation, and compliance remains the same for consumers. Consumer Lending has never been easier with our commercial lending software managing your data entry risks.

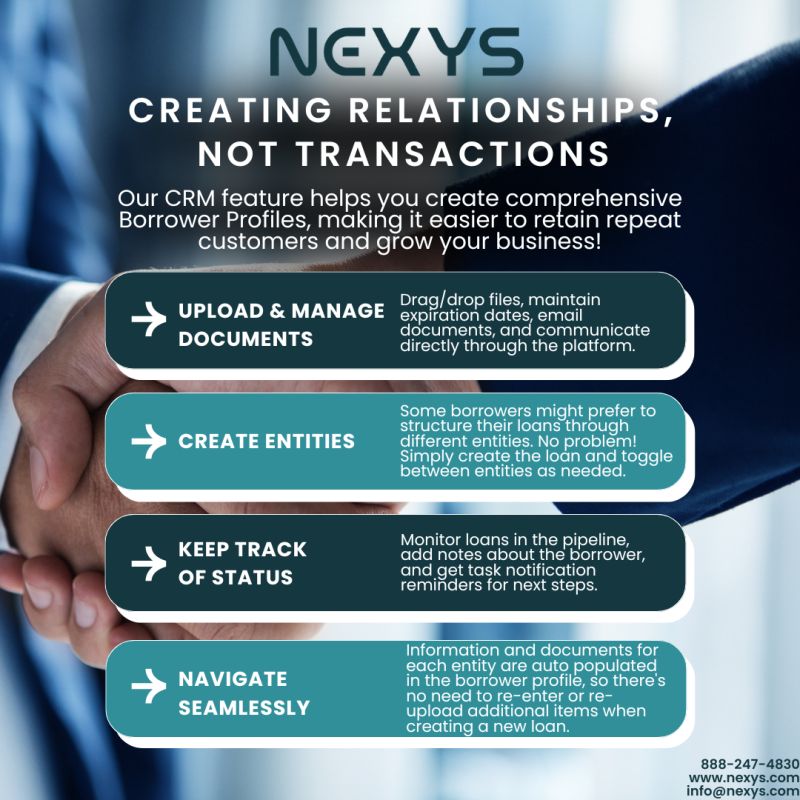

How Nexys Powers Smarter Commercial Lending For Banks

At Nexys, we built our commercial loan origination tools with flexibility, intelligence, and compliance in mind. Our platform supports the specific needs of business-purpose lenders—offering advanced workflows, entity-based underwriting, and full visibility from submission to close.

Whether you’re managing $500K bridge loans or $5M CRE deals, Nexys gives your team and consumers the tools to:

- Close faster without cutting corners

- Collaborate across departments and third parties

- Maintain compliance with a clean, auditable trail

- Scale your operations without sacrificing deal quality or risk

What is Nexys Commercial Loan Origination Software and How does it Affect Your Commercial Loan Origination System?

As commercial lending grows more competitive and regulatory pressure increases, the need for efficient, scalable tools becomes critical for growth insights. Commercial Loan Origination Software is no longer a nice-to-have—it’s a business necessity to process risk and make decisions – small or big for banking institutions to execute commercial loan origination.

If you’re ready to reduce complexity and originate commercial loans with confidence, it’s time to explore a platform built for your workflow. It’s time to explore Nexys Commercial Loan Origination Software.

📞 Contact us to learn more

📄 Request a commercial LOS demo today

Mortgage Loan Origination Software and Mortgage Lending Software vs Commercial Lending Software and Commercial Loan Origination

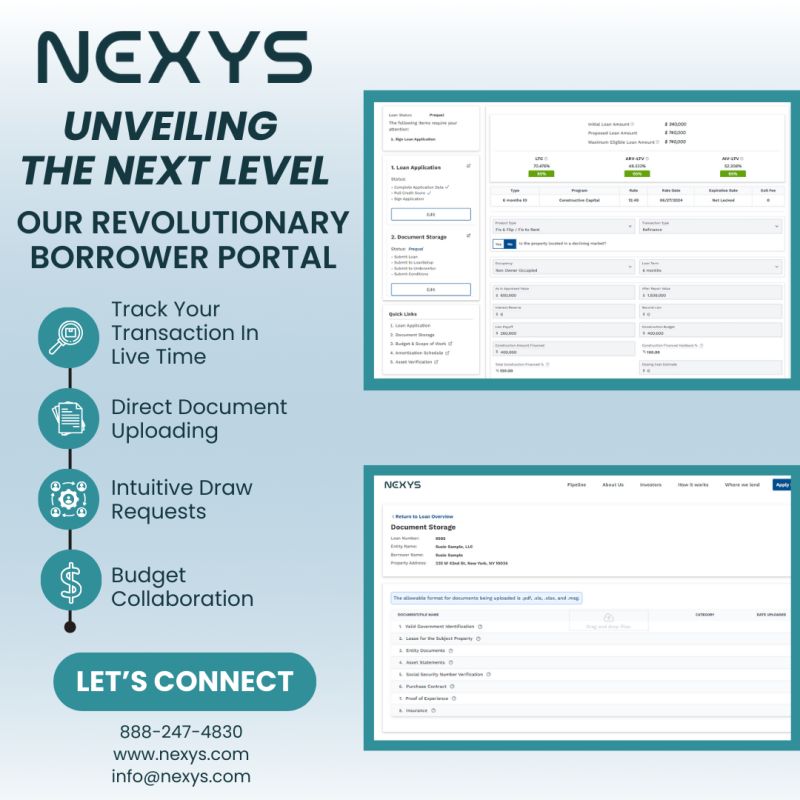

Nexys Loan Origination System is an advanced, modular LOS platform engineered to modernize and streamline every stage of the lending origination system process—from initial borrower intake to underwriting, document management, and funding. Unlike legacy systems that operate in silos. Asset management has never been so easy for consumer lending and financial institutions profitability and efficiency. Synergies between data silos help mitigate risk during data entry. Allowing for assets that streamline decision-making within the Nexys Ecosystem.

Operational decisioning software give consumers the ability to make better decisions throughout their underwriting process. Banking has never been easier for Consumers to make insights into their financial processes allowing them to make decisions with efficiency.

Streamline Home Financing with a Powerful Mortgage Loan Origination System and mortgage los systems

A modern mortgage loan origination system like Nexys simplifies every step of the home lending process—from borrower intake and pre-approval to underwriting, compliance, and funding. Built for speed and precision, it automates manual tasks, connects teams in real time, and ensures a smoother experience for both lenders and borrowers. Whether you’re handling conventional, FHA, or jumbo loans, Nexys helps you close faster with fewer bottlenecks and data entry risk management.

Deliver Seamless Home Mortgage Loan Software Experiences with Mortgage Origination Software

Mortgage origination software empowers lenders to streamline the entire home loan journey—from borrower intake and credit checks to disclosures and digital closings. With tools designed specifically for residential lending, Nexys efficiency ensures insights into faster approvals, efficiencies, synergies, automated compliance checks, and real-time insights into communication between loan officers, processors, and borrowers. It’s a smarter way to manage mortgage pipelines and close loans with confidence.

Empower Your Sales Pipeline with a Purpose-Built Mortgage Loan Officer CRM

A dedicated mortgage loan officer CRM gives originators the tools they need to build stronger borrower relationships, manage leads, and drive repeat business using insights from . Nexys offers CRM features designed specifically for mortgage professionals—centralizing communications, automating follow-ups, and tracking loan stages in real time. From referral tracking to personalized outreach, it’s the sales engine every loan officer needs to stay competitive in a fast-moving market.

Commercial Lending Software -Automated Commercial Loan Origination

Built for private lenders, banks, and real estate professionals, Nexys combines intelligent workflows, real-time collaboration, and built-in compliance tools to close loans faster, reduce manual work, and scale lending operations with precision and confidence.

Accelerate Commercial Lending Cycles and Loan Application with Intelligent Loan Processing That Comes With Commercial Lending Software

Nexys loan processing software helps lenders reduce turnaround times by automating key steps in the loan lifecycle. From document verification and condition tracking to communication with borrowers and underwriters, the platform ensures every task is handled quickly and accurately with intelligence—minimizing delays and maximizing productivity.

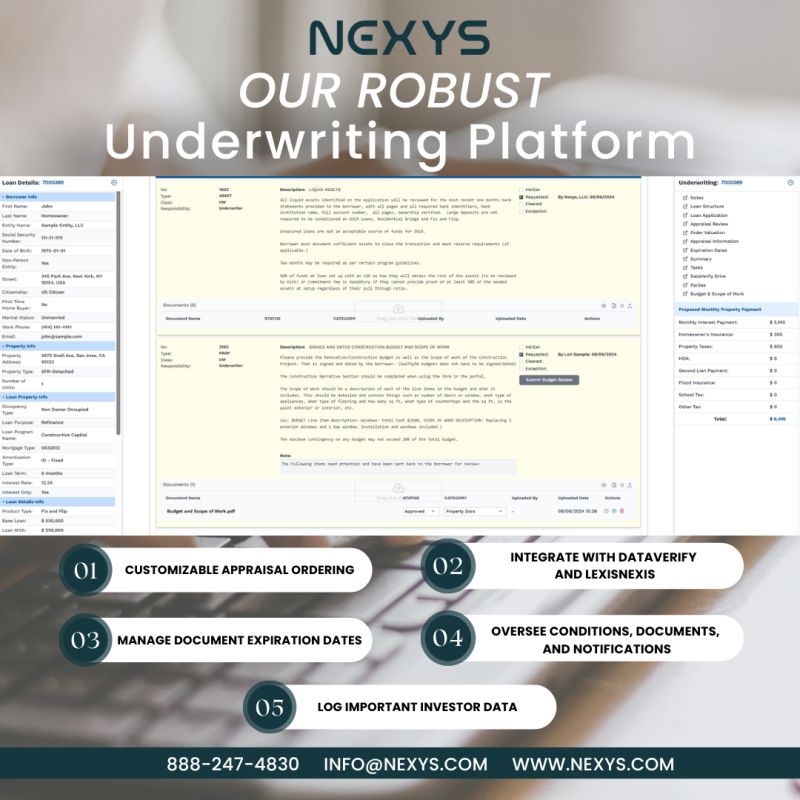

Enhance Risk Assessment Accuracy with Intelligent Modern Commercial Lending Loan Underwriting Software

Loan underwriting software like Nexys empowers lenders to evaluate borrower risk with greater precision and consistency. By automating income verification, debt ratios, and rule-based eligibility checks, underwriters can focus on complex decisions while the system handles the repetitive analysis. This leads to faster approvals, fewer errors, and stronger portfolio performance—all without compromising compliance or control.

Streamline Commercial Lending Operations with a Scalable Community Commercial Loan Origination Lending Platform

A modern loan origination platform like Nexys goes beyond basic loan processing—it serves as the central intelligence hub for managing borrowers, workflows, compliance, and funding in one unified environment. Designed for scalability and speed, Nexys empowers lenders to automate repetitive tasks, connect with third-party services, and gain real-time visibility into every stage of the loan cycle. Whether you’re a private lender or a growing financial institution, this platform adapts to your process and supports smarter, more efficient lending.

Intelligent Consumer Loan Origination Software Designed for Speed, Simplicity, Scale, and Community

Today’s borrowers expect fast approvals and a seamless digital experience. Nexys provides consumer or commercial loan origination software that automates income verification, credit checks, and eligibility rules—allowing lenders to process personal, auto, and unsecured loans with unmatched efficiency. From application to funding, every step is designed to reduce friction, ensure compliance, and deliver a borrower experience that builds trust and loyalty.

Intelligent Modern Lending Origination Software

Streamline Lending Origination Software Pipelines from Commercial Loan Application to Funding

Modern lenders need more than basic processing. Nexys simplifies the entire lifecycle—capturing borrower data, managing documents, automating decisions, and finalizing funding—all from a single, intuitive dashboard built for speed.

Connect Teams, Data, and Documents in One Unified System. Lending Origination System Built For Community.

Say goodbye to fragmented systems and disconnected processes. Nexys centralizes all loan activity, ensuring processors, underwriters, and compliance teams can collaborate seamlessly with intelligence and move loans forward faster.

Commercial Loan Software That Grows With you

Commercial loan origination software plays a critical role in transforming how financial institutions manage the lending lifecycle by unifying fragmented data silos, minimizing manual data entry, and improving decision-making through real-time intelligence. Designed to boost both efficiency and profitability, this software streamlines commercial loan processes while enabling synergies between consumer and commercial lending divisions. With a configurable menu of tools that address compliance, risk mitigation, and asset evaluation, institutions can create tailored strategies that align with evolving market demands.

Commercial Lending Made Easy

The platform promotes operational efficiencies that reduce processing time, eliminate redundancies, and improve the borrower experience—whether for a community bank or a national lender. By enhancing transparency and workflow automation, commercial loan origination software empowers teams to better serve both consumer and commercial lending portfolios while driving long-term strategic growth.