Nexys Loan Origination Software

At Nexys , we deliver cutting-edge Loan Origination software solutions that simplify financial technology and real estate operations. Discover how Nexys LOS solutions can transform the way you work.

Loan Origination Software (LOS system): A Modern Solution for Efficient Lending Origination Systems.

What is a Loan Origination Software?

Mortgage Loan Origination Software (LOS) is a digital platform that manages the entire loan lifecycle—from application and underwriting to approval and funding. Designed to streamline workflows, ensure compliance, and enhance borrower experiences, LOS platforms automate manual tasks, reduce processing times, and improve accuracy for lenders and mortgage brokers.

Nexys Commercial Loan Origination Software

Commercial Loan Origination Software to Automate Complex Workflows for Bridge, DSCR, and Real Estate Lending

Nexys is designed to handle the intricacies of business-purpose loans, offering customizable workflows for commercial real estate, DSCR, and short-term bridge lending. From pre-qualification to funding, every step is automated to minimize delays and maximize throughput.

Commercial Loan Origination Systems Built-In Entity Management and Compliance for Scalable Growth

Track borrower entities, corporate structures, and guarantors with ease. Nexys offers granular control over compliance workflows, making it simple to scale operations while maintaining data integrity, policy alignment, and audit readiness across your lending portfolio.

Why Nexys Stands Out as the Best Loan Origination Software for Modern Lenders

Choosing the best loan origination software means finding a solution that’s fast, flexible, and built for the real-world needs of today’s lenders. Nexys delivers exactly that—offering intelligent automation, customizable workflows, and end-to-end visibility across the entire lending cycle. Whether you’re managing consumer loans, mortgages, or complex commercial deals, Nexys adapts to your process, improves team efficiency, and helps you close more loans with confidence.

Loan Origination Software for Banks

Whether you’re a private lender, consumer, bank, or credit union, a modern LOS like Nexys empowers you to close loans faster, smarter, and with greater transparency.

The Best Loan Origination Software for Modern Lenders

What is Nexys Loan Origination Software and How does it Affect Your Loan Origination System?

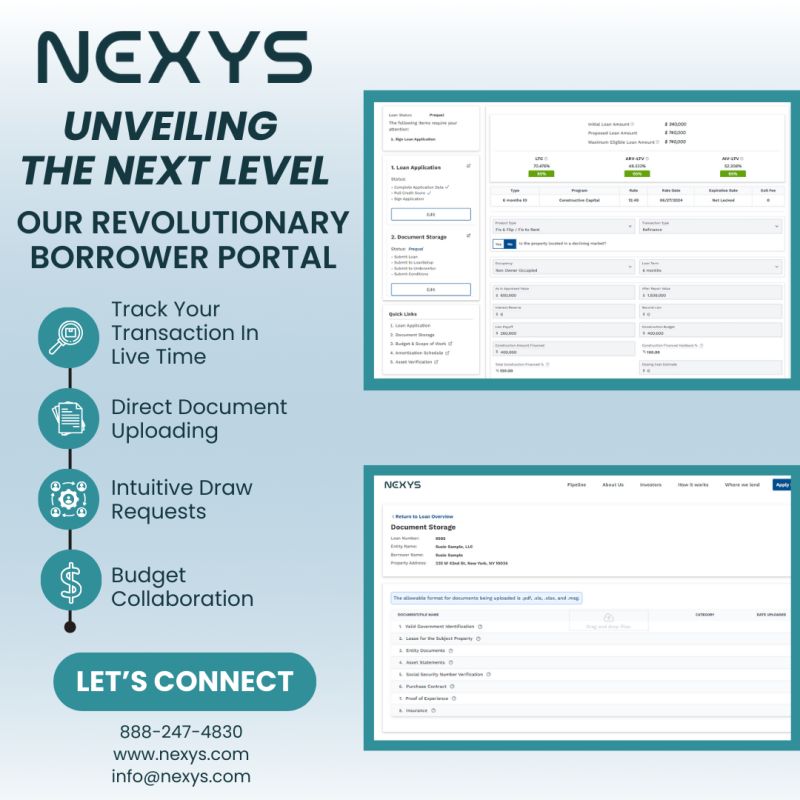

Nexys Loan Origination Software is a modern, end-to-end platform designed to streamline and automate every phase of the lending process—from borrower intake to underwriting and funding.

Mortgage Loan Origination Software and Mortgage Lending Software

Nexys Loan Origination System is an advanced, modular LOS platform engineered to modernize and streamline every stage of the lending origination system process—from initial borrower intake to underwriting, document management, and funding. Unlike legacy systems that operate in silos

Streamline Home Financing with a Powerful Mortgage Loan Origination System and mortgage los systems

A modern mortgage loan origination system like Nexys simplifies every step of the home lending process—from borrower intake and pre-approval to underwriting, compliance, and funding. Built for speed and precision, it automates manual tasks, connects teams in real time, and ensures a smoother experience for both lenders and borrowers. Whether you’re handling conventional, FHA, or jumbo loans, Nexys helps you close faster with fewer bottlenecks.

Deliver Seamless Home Mortgage Loan Software Experiences with Mortgage Origination Software

Mortgage origination software empowers lenders to streamline the entire home loan journey—from borrower intake and credit checks to disclosures and digital closings. With tools designed specifically for residential lending, Nexys ensures faster approvals, automated compliance checks, and real-time communication between loan officers, processors, and borrowers. It’s a smarter way to manage mortgage pipelines and close loans with confidence.

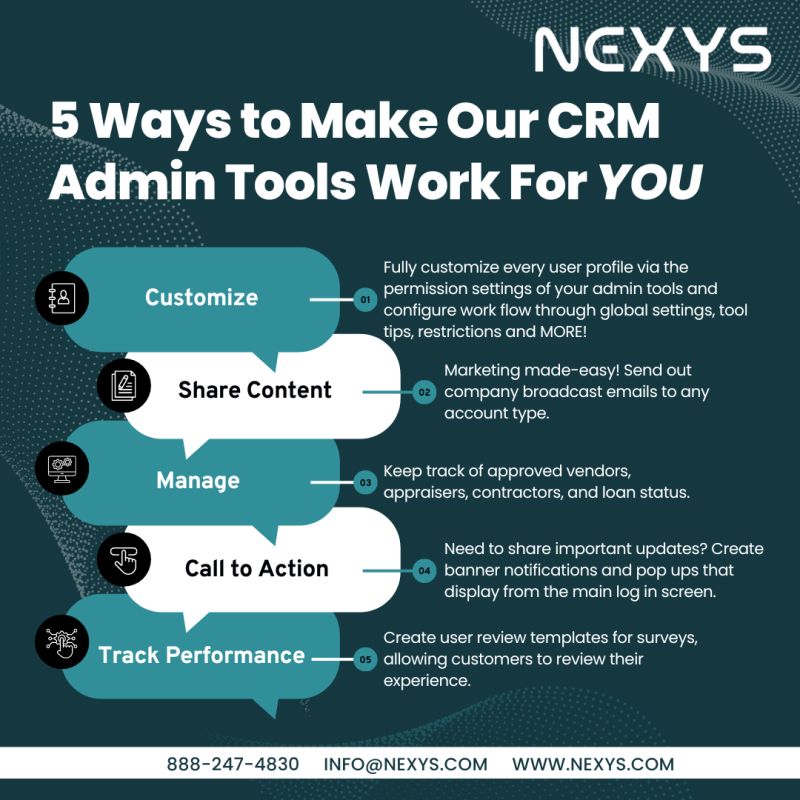

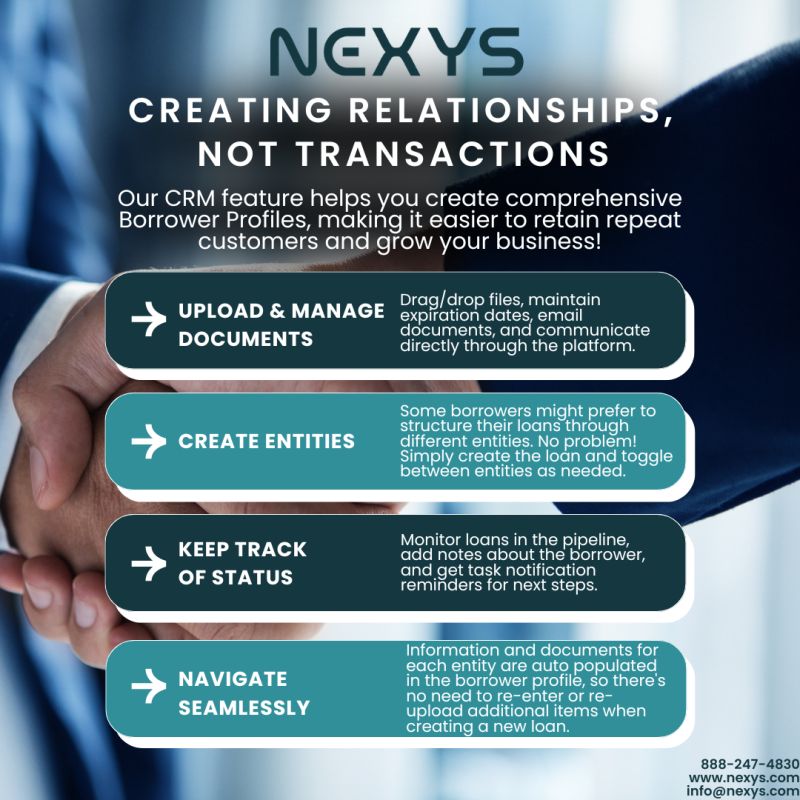

Empower Your Sales Pipeline with a Purpose-Built Mortgage Loan Officer CRM

A dedicated mortgage loan officer CRM gives originators the tools they need to build stronger borrower relationships, manage leads, and drive repeat business. Nexys offers CRM features designed specifically for mortgage professionals—centralizing communications, automating follow-ups, and tracking loan stages in real time. From referral tracking to personalized outreach, it’s the sales engine every loan officer needs to stay competitive in a fast-moving market.

Automated Loan Origination

Built for private lenders, banks, and real estate professionals, Nexys combines intelligent workflows, real-time collaboration, and built-in compliance tools to close loans faster, reduce manual work, and scale lending operations with precision and confidence.

Accelerate Loan Cycles and Loan Application with Intelligent Loan Processing Software

Nexys loan processing software helps lenders reduce turnaround times by automating key steps in the loan lifecycle. From document verification and condition tracking to communication with borrowers and underwriters, the platform ensures every task is handled quickly and accurately—minimizing delays and maximizing productivity.

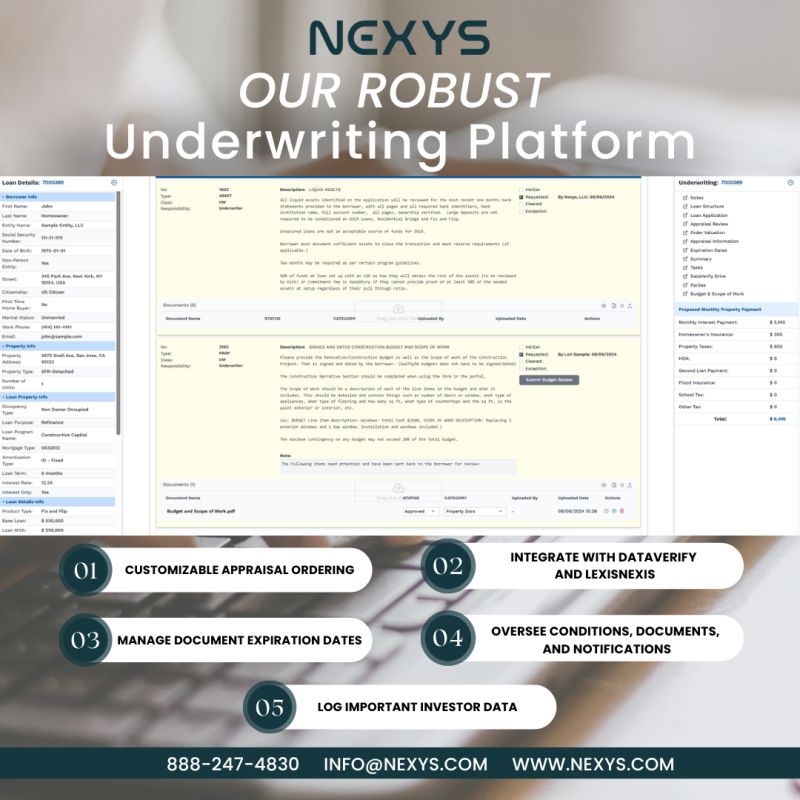

Enhance Risk Assessment Accuracy with Modern Loan Underwriting Software

Loan underwriting software like Nexys empowers lenders to evaluate borrower risk with greater precision and consistency. By automating income verification, debt ratios, and rule-based eligibility checks, underwriters can focus on complex decisions while the system handles the repetitive analysis. This leads to faster approvals, fewer errors, and stronger portfolio performance—all without compromising compliance or control.

Streamline Lending Operations with a Scalable Loan Origination Platform

A modern loan origination platform like Nexys goes beyond basic loan processing—it serves as the central hub for managing borrowers, workflows, compliance, and funding in one unified environment. Designed for scalability and speed, Nexys empowers lenders to automate repetitive tasks, connect with third-party services, and gain real-time visibility into every stage of the loan cycle. Whether you’re a private lender or a growing financial institution, this platform adapts to your process and supports smarter, more efficient lending.

Consumer Loan Origination Software Designed for Speed, Simplicity, and Scale

Today’s borrowers expect fast approvals and a seamless digital experience. Nexys provides consumer loan origination software that automates income verification, credit checks, and eligibility rules—allowing lenders to process personal, auto, and unsecured loans with unmatched efficiency. From application to funding, every step is designed to reduce friction, ensure compliance, and deliver a borrower experience that builds trust and loyalty.

Smart Credit Origination Software

Credit Risk Assessment Tools That Work in Real Time. Credit Origination Systems

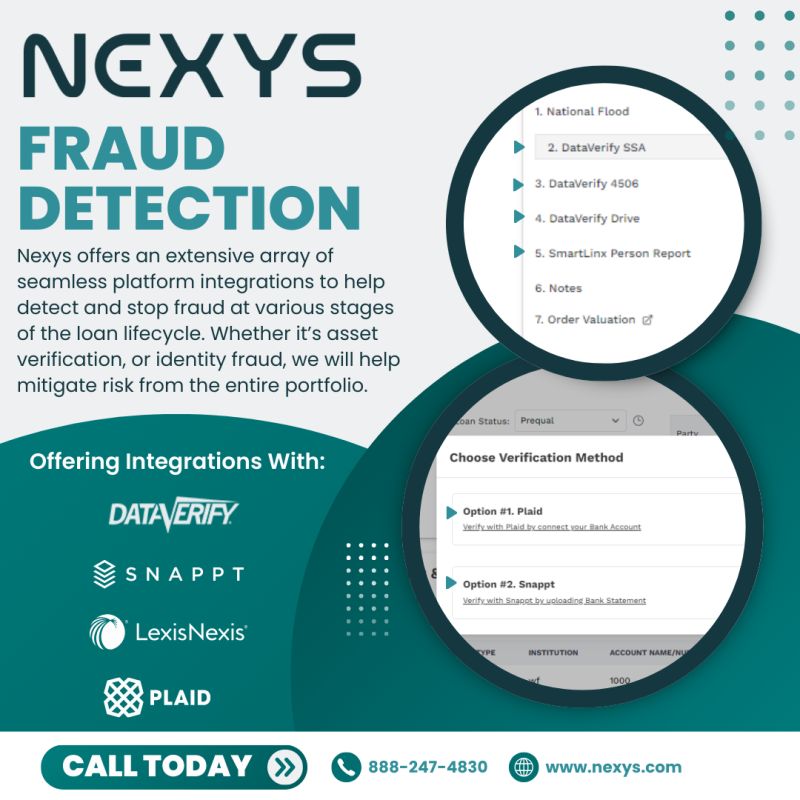

With Nexys, lenders gain access to integrated credit scoring engines and real-time verification tools. Instantly assess borrower eligibility and make confident decisions based on accurate, up-to-date data.

Seamless Integrations with Credit Origination Software Bureaus and Verification Vendors

Nexys connects directly to trusted providers like Xactus, CIC, and CTI, pulling in credit reports and borrower data without manual steps—reducing processing times and improving decision speed.

Modern Lending Origination Software

Streamline Lending Origination Software Pipelines from Commercial Loan Application to Funding

Modern lenders need more than basic processing. Nexys simplifies the entire lifecycle—capturing borrower data, managing documents, automating decisions, and finalizing funding—all from a single, intuitive dashboard.

Connect Teams, Data, and Documents in One Unified System Lending Origination System

Say goodbye to fragmented systems and disconnected processes. Nexys centralizes all loan activity, ensuring processors, underwriters, and compliance teams can collaborate seamlessly and move loans forward faster.