Nextres: Redefining Real Estate Financing with Nexys, LLC

Nextres, powered by Nexys, LLC, is revolutionizing the real estate financing landscape with cutting-edge technology and innovative solutions tailored to meet the needs of modern lenders and investors. As a flagship offering from Nexys, Nextres simplifies the complexities of real estate transactions, providing a streamlined platform for loan origination and property management. About Nextres Nextres was…

Lendbright: Empowering Real Estate Financing with Nexys, LLC

Lendbright, an innovative platform powered by Nexys, LLC, is revolutionizing real estate financing by providing cutting-edge solutions designed to simplify and accelerate the lending process. With its advanced features and user-centric design, Lendbright empowers real estate investors, lenders, and property managers to make smarter decisions and achieve their goals with confidence and efficiency. About Lendbright…

Commercial Nextres: Transforming Commercial Real Estate Financing with Nexys, LLC

Commercial Nextres, a flagship solution from Nexys, LLC, is revolutionizing the commercial real estate financing landscape with innovative tools and streamlined processes designed to meet the needs of modern lenders, investors, and developers. Built on Nexys’ commitment to innovation and excellence, Commercial Nextres empowers professionals to navigate the complexities of commercial real estate transactions with…

Kickstart 2025 with Nexys: The Future of Strategic Loan Origination Planning

Are you ready to elevate your strategic planning for 2025? The new year is just around the corner, and there’s no better time to ensure your team is equipped with the tools needed for success. Nexys is here to help you streamline your operations, optimize workflows, and meet your business goals with confidence. 🎯 Why…

Unlock a New Era of Loan Origination Software

Are you ready to transform the way you manage your loan origination process? The future is here, and Nexys is leading the charge with innovative solutions designed to streamline, simplify, and supercharge your workflow. Gone are the days of outdated systems and manual processes. With Nexys, you’ll gain access to cutting-edge technology that redefines efficiency,…

Stay on Track with Nexys: Introducing the Reminder Function!

Keeping up with your goals just got easier. With our new Reminder Function, you can effortlessly manage your tasks, stay on top of deadlines, and ensure you’re always moving forward. At Nexys, we believe in simplicity without compromise. Our tools are designed to help you focus on what truly matters—achieving your goals and staying organized,…

Streamline Your Workflow with Nexys’ Communication Hub

How can Nexys make your day-to-day easier? Introducing our Communication Hub, featuring Bidirectional Email Tracking, a game-changing tool designed to boost YOUR efficiency and simplify your workflow. Key Benefits of Bidirectional Email Tracking: Ready to elevate your communication game? Book a demo today and see how Nexys’ Communication Hub can transform your day-to-day operations!

Nexys is Thrilled to Attend LeverageCon 4 in Ft. Lauderdale!

Our team is excited to announce that Nexys, LLC will be attending LeverageCon 4, happening on Monday, January 13th at the Broward County Convention Center in sunny Ft. Lauderdale, FL! Join us alongside the nation’s premier Build | Flip | Rent finance experts for a day of unparalleled networking and industry insights. This event is…

Nexys Shines at the NPLA Conference: The Future of Loan Origination and Management Software

Check out our CEO, Kirk Ayzenberg, at the NPLA Conference! Together with Brian Giering, our SVP of Sales, Kirk showcased the premier loan origination and management platform tailored specifically for the non-bank lending industry. Why Nexys is the Answer for Modern LendersNexys offers unmatched customization and versatility, supporting a wide range of loan products, including:…

Introducing: Swift App

Say hello to Swift App, the ultimate tool for a streamlined application experience! Designed with speed and simplicity in mind, Swift App revolutionizes how brokers and lenders handle applications, making the process faster, more efficient, and user-friendly. Why Choose Swift App? Ready to elevate your application experience? Visit our website and book a demo today…

Frustrated with Your Current Systems? Nexys Has the Solution!

To all the #brokers and #lenders out there feeling stuck with outdated, inefficient systems—we’ve got you covered. At Nexys, we’ve designed a platform that eliminates the headaches and empowers you to focus on what truly matters: growing your business. Why Nexys? Stop struggling with systems that don’t work for you—experience the Nexys difference today! Let…

We Have What Others Don’t—Experience the Nexys Advantage

At Nexys, we offer something no one else does—the next level of loan origination and management software. Designed to revolutionize your lending operations, our platform delivers unmatched efficiency, innovation, and scalability. Why Choose Nexys? Experience what sets us apart—discover the Nexys difference today and take your business to the next level!

Nexys at the 15th Annual AAPL Conference: A Great Success!

Our CEO, Kirk Ayzenberg, and SVP of Sales, Brian Giering, had an incredible time attending the 15th Annual American Association of Private Lenders (AAPL) Conference! It was a pleasure connecting with industry leaders, innovators, and professionals dedicated to advancing private lending. If you didn’t get a chance to meet us, it’s not too late to…

Unlock the Next Level of Loan Origination Software with Nexys

Are you ready to take your lending operations to new heights? At Nexys, we’re redefining what’s possible with our innovative loan origination software, designed to streamline workflows, enhance efficiency, and empower your team to achieve more. What Makes Nexys Different? Ready to unlock the next level of loan origination? Let’s transform the way you work…

Visit Nexys at Booth #114 at the AAPL 15th Annual Conference!

We’re excited to meet you at the American Association of Private Lenders (AAPL) 15th Annual Conference! Be sure to stop by Booth #114 to connect with our leadership team and discover how Nexys is revolutionizing loan origination and management. Meet Our Team: Why Visit Nexys? We can’t wait to see you at Booth #114 in…

Nexys is Proud to Sponsor the 15th Annual AAPL Conference!

We are excited to announce that Nexys will be sponsoring the American Association of Private Lenders (AAPL) 15th Annual Conference, happening next week in Las Vegas! As a leader in financial technology and real estate solutions, Nexys is thrilled to support this premier event that brings together professionals, innovators, and thought leaders in private lending….

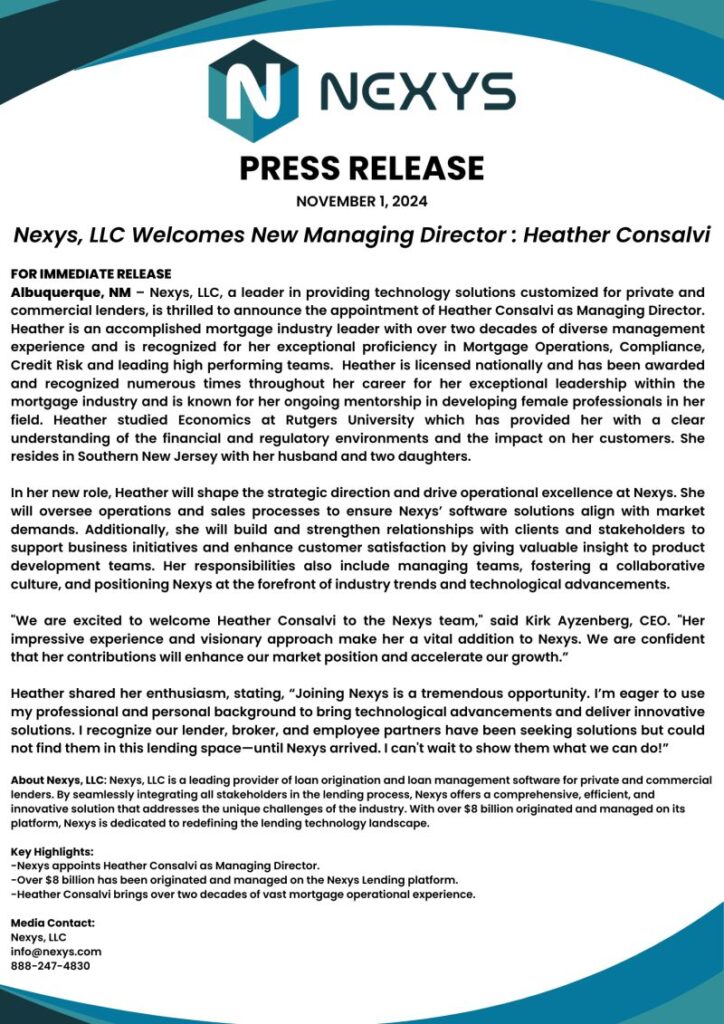

Nexys Welcomes Heather Consalvi as Managing Director!

We are excited to announce that Heather Consalvi has joined Nexys, LLC as our new Managing Director! With her exceptional leadership skills and extensive experience, Heather is poised to make a significant impact on our team and our mission to deliver innovative solutions for the financial and real estate industries. Why Heather is the Perfect…

Nexys: Seamless Integration with DataVerify, Xactus360, and SiteXPro

At Nexys, we are committed to enhancing your operations with powerful integrations. Our platform now seamlessly connects with DataVerify, Xactus360, and SiteXPro, bringing you unmatched efficiency and precision in loan origination and management. DataVerify Integration What it Delivers: Xactus360 Integration What it Delivers: SiteXPro Integration What it Delivers: Why Choose Nexys for Integrations? With Nexys’…

Nexys at the NPLA Conference in Austin: A Great Success!

Our CEO, Kirk Ayzenberg, and SVP of Sales, Brian Giering, had an incredible time attending the NPLA Conference in Austin! It was a fantastic opportunity to connect with industry leaders, share innovative ideas, and showcase Nexys’ cutting-edge loan origination and management software. If you didn’t get a chance to visit our booth, there’s still time…

Meet SVP Brian Giering at the NPLA Conference in Austin!

Heading to the NPLA Conference in Austin this week? Don’t miss the chance to connect with Brian Giering, Nexys’ Senior Vice President of Sales, from Sunday through Tuesday! Brian will be on-site to discuss how Nexys’ innovative solutions can streamline your lending operations and help you achieve your business goals. Why Connect with Brian? Whether…

Nexys is Proud to Sponsor the NPLA Conference October 27-29th!

We’re excited to announce that Nexys, LLC will be a sponsor at the upcoming NPLA Conference, taking place October 27-29th! This premier event brings together industry leaders, innovators, and professionals in private lending for insightful discussions, networking, and collaboration. We look forward to connecting with you, sharing our innovative solutions, and exploring how Nexys can…

Nexys at LeverageCon 3: A Memorable Experience!

Our CEO, Kirk Ayzenberg, and SVP of Sales, Brian Giering, had an incredible time attending LeverageCon 3! It was a fantastic opportunity to connect with industry leaders, share insights, and showcase Nexys’ innovative loan origination and management software. If you didn’t get a chance to stop by our booth, it’s not too late to learn…

Meet Brian Giering at LeverageCon 3 this week!

We’re excited to announce that Brian Giering, Nexys’ Senior Vice President of Sales, will be at LeverageCon 3 this week! If you’re interested in taking your lending operations to the next level, stop by our booth to learn more about Nexys’ innovative loan origination and management software. From automation to real-time analytics, our platform is…

Expand Your Possibilities with Nexys’ Loan Software

At Nexys, we’re always enhancing our platform to help you achieve more. We’re excited to announce new integrations with SiteXPro, Obie, and Valuation Services AMC, LLC, making it easier than ever to streamline your lending operations and maximize efficiency. What These Integrations Mean for You: Why Choose Nexys?Our loan software is designed to provide a…

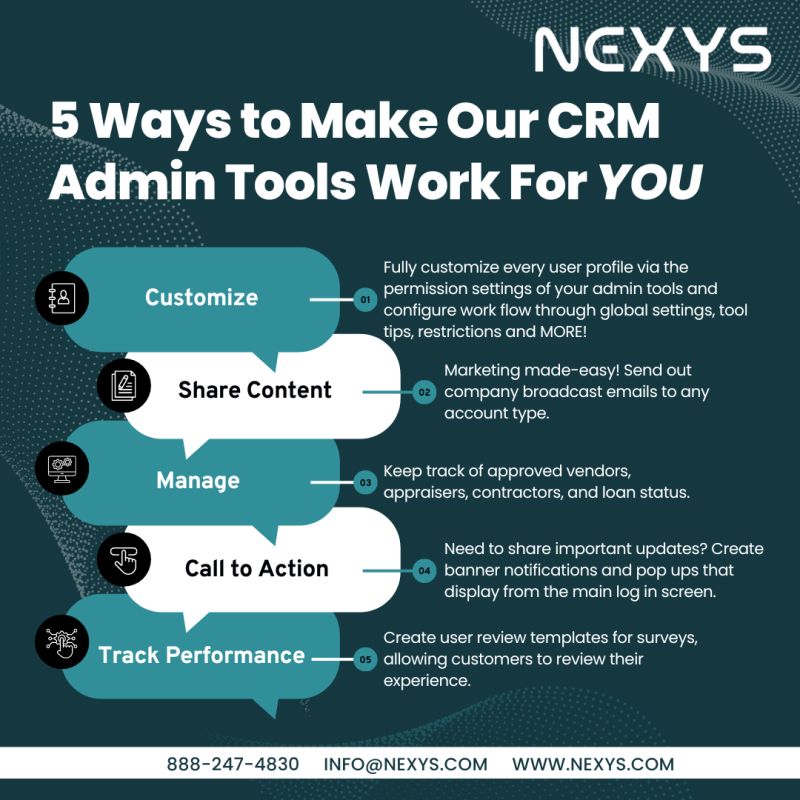

Explore Nexys’ CRM Admin Tools

Take control of your customer relationship management with Nexys’ CRM Admin Tools. Designed to streamline operations and optimize team workflows, these tools provide the flexibility and control you need to manage your business effectively. Key Features: Want to learn more? Book a demo with us today and see how Nexys’ CRM Admin Tools can revolutionize…

Exciting News: Nexys Now Integrated with Nationwide Appraisal Network (NAN)!

We’re thrilled to announce that Nexys has partnered with Nationwide Appraisal Network (NAN) to deliver seamless integration for appraisal management. This powerful collaboration streamlines the appraisal process, ensuring faster, more accurate, and efficient workflows for lenders and real estate professionals. What This Integration Means for You: With this integration, Nexys continues to expand its ecosystem…

Introducing The Nexys CRM: Redefining Customer Relationship Management

At Nexys, we’re excited to introduce our CRM solution—designed to help you manage client relationships, streamline communication, and drive growth with ease. Why Choose The Nexys CRM? Ready to transform how you manage client relationships? Book a demo today and see how the Nexys CRM can help you take your business to the next level!

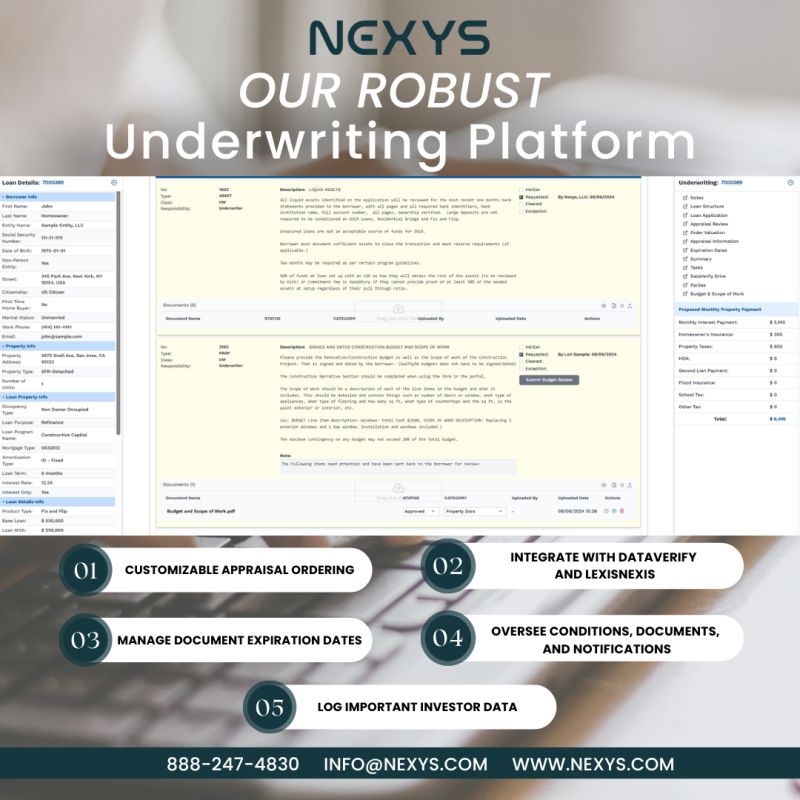

Discover Nexys’ Underwriting Platform

Curious about how Nexys can transform your underwriting process? Our Underwriting Platform is designed to streamline workflows, enhance accuracy, and ensure compliance, all while saving you time and effort. Key Benefits of the Nexys Underwriting Platform: Want to learn more? Schedule a demo with us today and see how Nexys’ Underwriting Platform can elevate your…

Nexys at Captivate 2024: A Memorable Experience!

Our team had an incredible time attending the Captivate 2024 Conference, hosted by Geraci Conferences! It was a fantastic opportunity to connect with industry leaders, share insights, and showcase how Nexys is transforming the world of loan origination and management. If you’re ready to take your lending operations to the next level with our innovative…

Providing Seamless Integration, Every Step of the Way with Xactus360!

At Nexys, we believe in making every process as smooth and efficient as possible. With Xactus360 Integration, we’re bringing seamless connectivity to your lending operations, ensuring precision and efficiency at every stage. Key Benefits of the Xactus360 Integration: From start to finish, Nexys and Xactus360 work together to streamline your operations, saving time and delivering…

A Special Thanks to Nexys, LLC for Sponsoring Captivate 2024!

We are thrilled to announce Nexys, LLC as a sponsor for this year’s Captivate 2024 Conference! Nexys, a leader in financial technology, delivers scalable solutions designed for both small lending institutions and large enterprises. Their innovative software offers more than just functionality—it’s a partnership that empowers businesses to achieve growth and profitability in today’s dynamic…

Meet Brian Giering, Nexys’ SVP, at Captivate 2024!

Nexys, LLC is excited to announce that our Senior Vice President of Sales, Brian Giering, will be attending the Captivate 2024 Conference, hosted by Geraci Conferences. This premier event is a gathering of industry leaders, innovators, and professionals in private lending and financial technology, making it the perfect opportunity to connect and collaborate. Event Details:…

Workflow Automation by Nexys

Streamline your operations and maximize efficiency with Nexys’ Workflow Automation. Designed to reduce manual tasks and optimize processes, this feature ensures that your team can focus on what matters most—delivering exceptional results. Key Benefits: Want to learn more about how Workflow Automation can transform your business?Book a demo with us today and discover the power…

Appraisal Dashboard

Simplify and streamline your appraisal management process with Nexys’ Appraisal Dashboard. This intuitive tool offers real-time visibility into every stage of the appraisal process, helping you stay organized and efficient. Key Benefits: Want to see how the Appraisal Dashboard can transform your operations? Book a demo with us today and experience the difference Nexys can…

Custom Reporting Tailored to Your Needs

At Nexys, we understand that every company has unique goals and requirements. That’s why our Custom Reporting feature is designed to fit YOUR business needs, giving you the flexibility to create insightful, actionable reports that align with your objectives. Key Benefits: Ready to take control of your data? Book a demo with us today and…

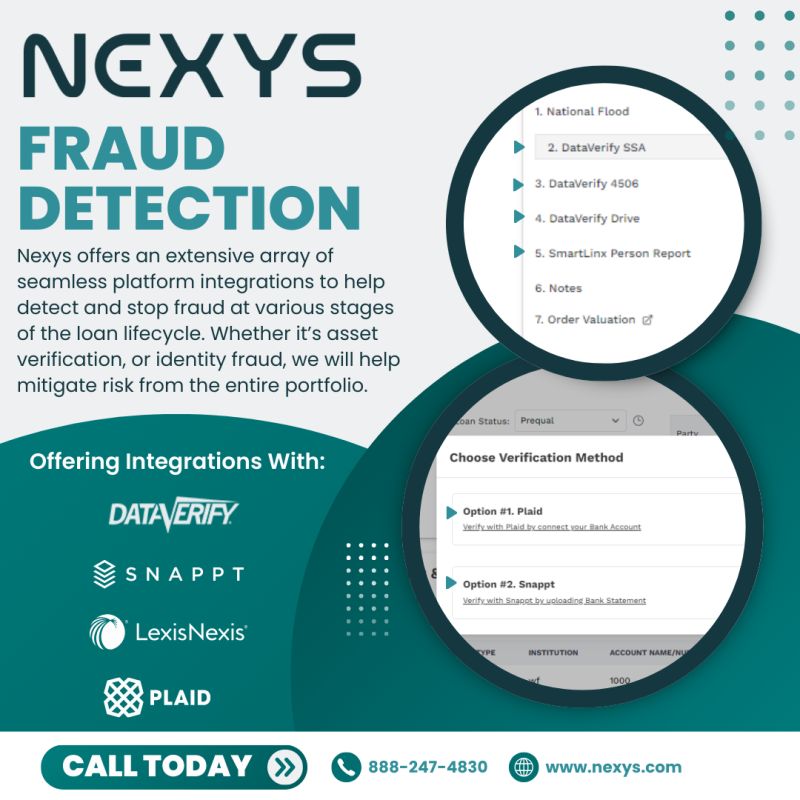

Nexys’ Advanced Fraud Detection

Stay ahead of potential risks with Nexys’ Advanced Fraud Detection, a cutting-edge solution designed to protect your business and streamline operations. Leveraging powerful analytics and real-time data, this feature helps lenders and property managers identify and mitigate fraudulent activities before they impact your bottom line. Key Benefits: Ready to experience fraud detection that works smarter?…

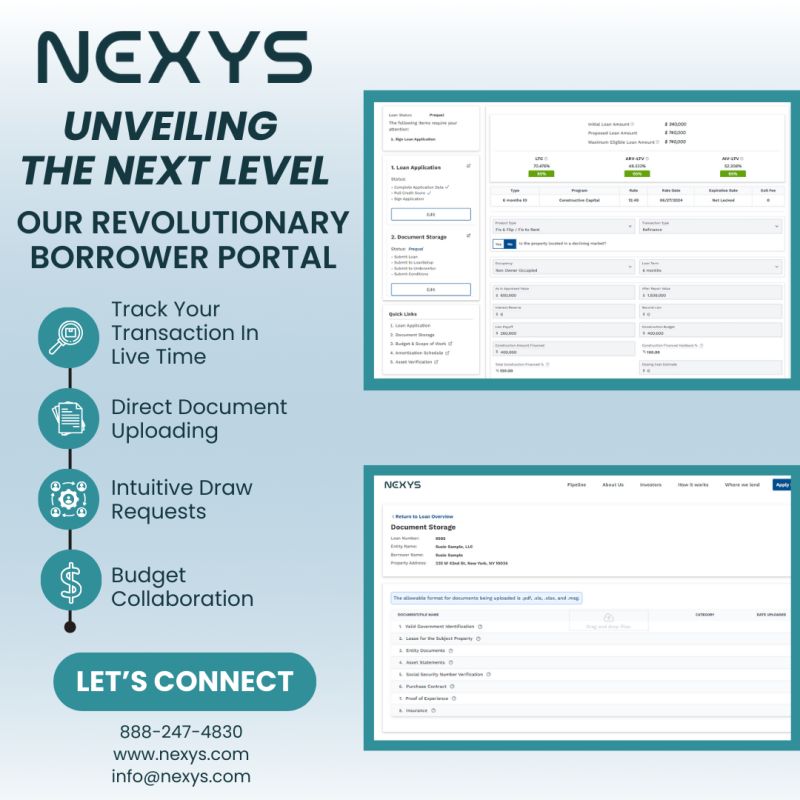

Nexys’ Intuitive Budget Collaboration

Streamline your financial planning and enhance teamwork with Nexys’ Intuitive Budget Collaboration feature. Designed for lenders, property managers, and real estate professionals, this tool simplifies budget management, fosters seamless collaboration, and ensures accuracy across all stakeholders. Key Benefits: Ready to see it in action? Book a demo with us today and discover how Nexys is…

Nexys’ Revolutionary Borrower Portal—Streamlining Lending Like Never Before

At Nexys, we’re committed to creating innovative, user-centric solutions that transform the lending process. One standout feature of our comprehensive platform is the Borrower Portal, a revolutionary tool designed to simplify and enhance the borrower experience. And that’s just the beginning—our platform also includes a suite of role-specific portals, each tailored to meet the unique…

Introducing Nexys Feature Solutions: The NEXT Level of Private Lending Software

At Nexys, we’re redefining what’s possible in private lending and real estate technology. Our innovative software solutions are designed to simplify complex workflows, enhance operational efficiency, and empower lenders, real estate professionals, and investors to succeed in today’s fast-paced market. Why Choose Nexys?Nexys Feature Solutions offer advanced tools for: Experience the DifferenceDiscover how Nexys is…

FCI Integration: Nexys API Enhances Loan Servicing Solutions

Effective loan servicing is a cornerstone of successful lending operations, requiring precision, compliance, and timely updates. Nexys, a leader in loan origination and financial technology, has partnered with FCI, a trusted name in loan servicing, to deliver a seamless API integration. This advanced solution automates servicing processes, ensures regulatory compliance, and provides real-time portfolio updates,…

Obie API Integration: Simplifying Real Estate Insurance with Nexys

Navigating real estate insurance can be a complex and time-consuming process for property managers and real estate investors. To address this challenge, Nexys has partnered with Obie, a leader in modern insurance technology, to deliver an API integration that simplifies real estate insurance solutions. This seamless connection provides instant access to insurance quotes and coverage…

SmartLinx Person Report: Nexys API for Enhanced Tenant Screening Solutions

In the property management and lending industries, making informed decisions about tenants and borrowers is critical to mitigating risks and protecting investments. Nexys, a leader in loan origination and property management technology, has partnered with SmartLinx Person Report to deliver an API integration that transforms tenant screening. This seamless connection provides instant access to comprehensive…

USPS API Integration: Nexys Streamlines Address Verification and Management

Accurate address data is a cornerstone of successful loan processing and property management. Nexys, a leader in loan origination technology, has integrated with the United States Postal Service (USPS) to deliver an API solution that simplifies address verification and management. This integration ensures precise borrower and property information, reducing errors and improving operational efficiency across…

Snappt API Integration: Enhancing Fraud Detection and Tenant Verification with Nexys

In the lending and property management industries, fraud detection and tenant verification are critical to mitigating risks and safeguarding investments. Nexys, a leader in loan origination and financial technology, has partnered with Snappt to deliver an API integration that enhances these processes. This powerful connection enables lenders and property managers to quickly identify fraudulent applications,…

Plaid API Integration: Nexys Powers Financial Connectivity

In today’s fast-paced lending environment, seamless access to financial data is key to efficient operations and faster loan approvals. Nexys, a leader in loan origination technology, has partnered with Plaid to deliver an API integration that enhances financial connectivity. By linking borrower bank accounts directly to the Nexys platform, this integration simplifies verification processes, provides…

Nexys and Stripe: API Integration for Secure Payment Processing

In the digital age, secure and efficient payment processing is essential for modern lending operations. To meet this need, Nexys has partnered with Stripe, a global leader in payment technology, to deliver a seamless API integration. This collaboration enables lenders to process transactions securely, ensure compliance, and enhance borrower experiences through streamlined payment workflows. How…

Nexys API Integration with Service Link: Driving Data and Efficiency

In the competitive lending industry, accurate property data and efficient workflows are critical for success. Nexys, a leader in loan origination technology, has partnered with Service Link to deliver an advanced API integration that streamlines property data management for lenders. This powerful collaboration empowers lenders with tools to process loans faster, evaluate risks more accurately,…

Seamless Risk Management with Data Verify Integration by Nexys

In today’s lending landscape, effective risk management is vital to ensuring secure and compliant operations. Nexys, a leader in loan origination and financial technology, has partnered with Data Verify to deliver an API integration that simplifies and strengthens risk assessment processes. This seamless solution enables lenders to verify borrower identities, income, and credit histories in…

Elite Valuation API Integration: Nexys Enhances Appraisal Efficiency

Accurate and timely appraisals are critical in the lending industry. To address this need, Nexys, a leader in loan origination technology, has partnered with Elite Valuation to deliver an API integration that redefines appraisal efficiency. This advanced solution automates valuation processes, ensures consistent results, and significantly reduces turnaround times, enabling lenders to make faster and…

Nexys Partners with Nationwide Appraisal Network (NAN) for Enhanced Appraisal Management

Accurate and efficient appraisal management is crucial for successful lending operations. To streamline this process, Nexys, a leader in loan origination technology, has partnered with Nationwide Appraisal Network (NAN) to deliver a cutting-edge API integration. This collaboration revolutionizes how lenders handle appraisals, providing seamless access to reports, real-time updates, and automated tracking to enhance operational…

Streamlined Valuation Services with Nexys’ VSAMC API Integration

Property valuations play a critical role in lending decisions, requiring speed, accuracy, and reliability. Nexys, a leader in loan origination technology, has partnered with Valuation Services AMC (VSAMC) to deliver an API integration that transforms how lenders manage appraisals. This advanced integration ensures seamless data exchange, enabling lenders to complete valuations quickly and with confidence….

Appraisal Nation Integration: Nexys’ API for Comprehensive Valuation Management

Accurate and efficient property valuation is a cornerstone of successful lending operations. Nexys, a leader in loan origination and financial technology, has partnered with Appraisal Nation to deliver a comprehensive valuation management solution through seamless API integration. This powerful collaboration enables lenders to access real-time appraisal data, automate report generation, and maintain compliance with industry…

Revolutionizing Lending Operations with Bytepro API Integration

In the fast-evolving lending industry, efficiency and seamless data management are paramount. Nexys, a leader in loan origination technology, has partnered with Bytepro to deliver a powerful API integration that revolutionizes lending operations. This collaboration automates key processes, enhances data flow, and significantly improves the borrower experience, setting a new standard for efficiency and innovation…

RTL Trader Integration: Nexys API for Advanced Rental Pricing Solutions

Nexys is revolutionizing rental market operations through its powerful integration with RTL Trader, offering cutting-edge rental pricing solutions tailored for property managers and real estate investors. This API-driven integration provides unparalleled market insights, automated pricing strategies, and real-time analytics, empowering users to maximize profitability and streamline operations in the competitive rental market. How the Integration…

Empowering Real Estate Operations with Trinity Integration via Nexys

In the fast-paced world of real estate, accurate data management and streamlined workflows are critical for success. Nexys, a leader in financial technology and real estate solutions, has partnered with Trinity to deliver an API integration that revolutionizes real estate operations. This collaboration empowers professionals with advanced tools to automate workflows, improve data accuracy, and…

Simplified Document Generation with Nexys’ Docgen API Integration

In the lending industry, accurate and efficient document generation is essential for streamlining operations and ensuring compliance. Nexys, a leader in loan origination and financial technology, has partnered with Docgen to deliver an API integration that automates the creation and management of critical loan documents. This powerful integration enhances efficiency, reduces errors, and ensures regulatory…

Nexys API Powers ServiceLink National Flood Data Integration

Accurate property risk assessment is a cornerstone of the lending process, particularly when it comes to flood zone determination. Nexys, a leader in financial technology and loan origination solutions, has partnered with ServiceLink National Flood to deliver a seamless API integration that simplifies flood zone data access for lenders. This powerful integration enhances efficiency, ensures…

Simplifying Income Verification with Dataverify 4506 Integration by Nexys

Income verification is a critical step in the loan approval process, requiring accuracy, security, and speed. To address these demands, Nexys has partnered with Dataverify 4506 to offer a seamless API integration that revolutionizes income verification for lenders. This advanced solution provides secure access to IRS tax transcripts, enabling faster, more accurate underwriting decisions. The…

Enhancing Security with Dataverify SSA API Integration by Nexys

In today’s lending environment, identity verification is critical to maintaining security, reducing fraud, and ensuring compliance with stringent regulations. Recognizing these needs, Nexys has partnered with Dataverify SSA to deliver seamless and secure access to Social Security Administration (SSA) verification services. This advanced API integration empowers lenders to validate borrower identities with unmatched efficiency and…

Nexys Partners with Xactus360 for Seamless Credit Reporting Integration

In the competitive world of lending, access to accurate and timely credit data is critical for informed decision-making. Nexys, a leader in loan origination and financial technology, has partnered with Xactus360, a trusted name in credit reporting, to deliver a seamless API integration that revolutionizes how lenders access and utilize credit data. The Power of…

Streamlining Credit Reporting with CIC Credit Integration by Nexys

In today’s fast-paced lending environment, having access to reliable and efficient credit reporting tools is essential. Nexys, a leader in loan origination and financial solutions, proudly offers seamless API integration with CIC Credit, enabling lenders to streamline their credit reporting processes and enhance decision-making capabilities. Why CIC Credit Integration Matters CIC Credit is a trusted…

Nexys Now Offering API Integrations for SitexPro: A New Era of Seamless Connectivity

In today’s fast-paced real estate and financial technology landscape, seamless data flow and system integration are crucial for operational success. Recognizing this, Nexys, a leader in loan origination and real estate solutions, is proud to announce its API integration capabilities tailored specifically for SitexPro, a premier platform for real estate professionals. With this collaboration, Nexys’…

Nexys, LLC Considers Joining the Geraci Innovate Conference 2025

Nexys is exploring participation in the Geraci Innovate Conference, scheduled for August 21–22, 2025, at the Vea Hotel in Newport Beach, CA. As a prominent event for innovation in the private lending sector, this conference focuses on technology, business strategies, and operational efficiency. Why Innovate 2025?The Geraci Innovate Conference is a hub for forward-thinking professionals…

Nexys, LLC Looks Into Attending the National Private Lenders Conference (NPLA) June 2025

The National Private Lenders Conference (NPLA), happening on June 23–24, 2025, at the Hard Rock in Atlantic City, NJ, is another potential opportunity for Nexys, LLC. As one of the premier events for private lenders, the NPLA Conference offers rich insights and opportunities to connect with industry leaders. Why NPLA June 2025?NPLA’s focus on innovation…

Nexys, LLC Evaluates Joining LeverageCon 5

Scheduled for May 14, 2025, at the Fairmont Dallas in Dallas, TX, LeverageCon 5 is another key event Nexys, LLC is considering. Known for its focus on empowering private lenders, this conference provides a forum for exploring strategies, technology, and partnerships. Why LeverageCon 5?LeverageCon 5 is tailored for professionals seeking to stay ahead in a…

Nexys, LLC Explores Potential Attendance at the Geraci Captivate Conference 2025

The Geraci Captivate Conference, taking place on May 1–2, 2025, at the Encore at Wynn Las Vegas, is on Nexys’ radar for participation. This high-profile event focuses on connecting lenders, investors, and capital providers, offering unparalleled insights into the private lending landscape. Why Captivate 2025?Captivate provides a unique platform for deal-making and networking among the…

Nexys, LLC Eyes Participation in the 2025 American Lending Conference

Nexys, LLC is also considering attending the 2025 American Lending Conference, scheduled for March 21–22, 2025, at the Green Valley Ranch Resort Spa & Casino in Las Vegas, NV. Known for its focus on fostering connections between lenders, brokers, and technology providers, this conference is a hub for innovation and collaboration in the lending industry….

Nexys, LLC Considers Attending the 2025 California Mortgage Association Spring Conference

Nexys, LLC is evaluating participation in the 2025 California Mortgage Association (CMA) Spring Conference, which will be held from March 5–7, 2025, at the Grand Hyatt Regency Indian Wells Spa in Indian Wells, CA. This event is a gathering point for mortgage professionals across California and beyond, offering a deep dive into market trends, regulatory…

Nexys, LLC to Participate in the National Private Lenders Conference (NPLA)

Nexys, LLC is proud to announce its participation in the National Private Lenders Conference (NPLA), taking place from March 16–18, 2025, at the Loews Miami Beach Hotel in Miami, FL. As one of the most significant events in the private lending industry, NPLA brings together top professionals, thought leaders, and innovators for three days of…

Nexys, LLC Joins IMN Residential Lenders Forum on DSCR & RTL

Nexys, LLC is excited to announce its participation in the IMN Residential Lenders Forum on DSCR & RTL, taking place on January 15–16, 2025, at the JW Marriott Turnberry in Aventura, FL. This event is specifically designed for professionals in the residential lending industry, focusing on Debt-Service Coverage Ratio (DSCR) and Rental Term Loan (RTL)…

Nexys, LLC to Attend LeverageCon 4 – National Lending Experts

Nexys, LLC is thrilled to announce its participation in LeverageCon 4 – National Lending Experts, a premier event for private lenders and financial professionals. Scheduled for January 13, 2025, at the Broward County Convention Center in Fort Lauderdale, FL, LeverageCon 4 promises to deliver valuable insights, networking opportunities, and the latest developments in the lending…

Nexys, LLC to Explore Future Opportunities at the National Private Lender Expo

Nexys, LLC had initially planned to attend the National Private Lender Expo, scheduled for November 20–21, 2025, at the iconic Eden Roc Hotel in Miami, FL. This prestigious flagship event attracts elite professionals in the private lending industry, offering unparalleled opportunities for networking, knowledge-sharing, and showcasing innovative solutions. While Nexys is unable to participate in…

Nexys, LLC Plans to Participate in Future SuperReturn Private US Conferences

Nexys, LLC had initially planned to participate in the Informa Connect – SuperReturn Private US Conference, scheduled for November 12–13, 2024, at the Marriott Marquis in Times Square, NY. This prestigious event focuses on private credit and alternative assets, bringing together global leaders and innovators in the financial industry. While circumstances have prevented Nexys from…

Nexys, LLC to Exhibit at the 2024 American Association of Private Lenders (AAPL) Annual Conference

Nexys, LLC is thrilled to announce its role as an exhibitor at the American Association of Private Lenders (AAPL) Annual Conference, taking place from November 10–11, 2024, at the renowned Caesars Palace in Las Vegas, NV. This premier event is a cornerstone for professionals in the private lending industry, offering a platform to connect, learn,…

Nexys, LLC to Participate in the 2024 National Private Lenders Conference (NPLA)

Nexys, LLC is excited to announce its participation in the National Private Lenders Conference (NPLA), taking place from October 27–29, 2024, at the prestigious Fairmount Hotel in Austin, TX. This annual event brings together leaders and innovators in the private lending industry, providing an unmatched opportunity to share insights, network with peers, and explore emerging…